Are you looking for a way to invest in real estate while also making a positive impact on the planet and its people? Look no further than sustainable development goals! By aligning your investment strategies with these global goals, you can not only create profitable returns but also contribute to the greater good. In this blog post, we’ll explore how sustainable development goals meet real estate investment – it’s a win-win situation that benefits both investors and society as a whole. Let’s dive in!

Sustainable development goals

The United Nations has set out a series of goals to be achieved by 2030 in order to promote sustainable development. The eight goals are:

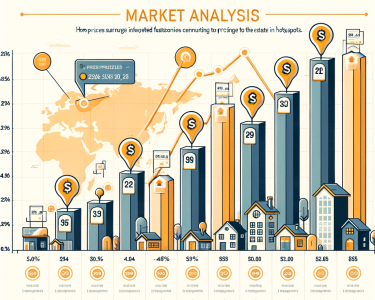

Real estate developers are already taking notice of the potential for sustainability and environmentalism in the real estate market. A recent study by JLL found that 54% of real estate professionals think that Sustainable Development Goals could have a positive impact on the real estate market, while only 25% believe they will have a negative impact. In many cases, achieving sustainable development goals can actually be good for real estate investment.

Sustainability is about creating systems that we can rely on over time, without compromising our ability to meet current needs. That’s why it’s important to think about sustainability when looking at real estate investments. For example, making sure a building is energy efficient can help minimize emissions and save money on bills. It also creates Jobs in the construction industry and supports local economies.

Investors who are looking for ways to support sustainable development should consider investing in properties with low carbon footprints or those that promote green building practices. Properties with these features can often be more expensive than others, but they’re worth it if they lead to long-term savings and healthier environments for everyone who lives nearby.

Real estate investment

The Sustainable Development Goals (SDGs) provide a blueprint for solving the world’s most pressing problems. One of the SDGs is to reduce poverty, inequality and environmental degradation. The real estate industry is one of the most environmentally damaging sectors in the world, so it makes perfect sense that sustainable development goals would intersect with real estate investment.

There are two ways in which sustainable development goals can impact real estate investment: by encouraging better practices and by penalizing unsustainable investments. The first way is through regulations and guidelines from governments and agencies. For example, the Paris Agreement sets global targets for reducing emissions from land use, transport and buildings.

The second way is through market incentives. Governments can put in place taxes or subsidies to encourage sustainable investments, or they can ban certain activities altogether. For example, the EU has introduced restrictions on new building permits for high-emitting industries such as energy production and shipping. This has led to an increase in renewable energy projects and a decrease in CO2 emissions from traditional energy sources.

Both approaches have benefits for people and planet Earth. Regulations help improve hygiene, air quality and climate control, while market incentives create jobs and stimulate economic growth without increasing greenhouse gas emissions. In sum, meeting the SDGs through real estate investment creates a win-win situation for everyone involved – including the environment!

Benefits of sustainable real estate investment

Sustainable development goals (SDGs) are an international effort to reduce environmental impacts and improve the quality of life for all people. The SDGs were announced by UN Secretary General Ban Ki-moon in 2015 and aim to be achieved by 2030. Real estate investment has emerged as a key sector within the SDG framework, with potential to play a significant role in delivering on these goals.

The benefits of sustainable real estate investment can be broadly divided into three categories: environmental, social, and economic.

Environmental benefits of sustainable real estate investment include reducing pollution, mitigating climate change, and protecting natural resources. By investing in sustainably designed buildings and practices, real estate investors can contribute to a reduction in pollution levels globally. Furthermore, investing in environmentally friendly projects can also help Reduce greenhouse gas emissions, which is essential if we are to meet global targets set by the Paris Agreement on Climate Change.

Social benefits of sustainable real estate investment include improving access to housing for low-income earners, promoting human rights, and helping developing countries develop economically. By investing in socially responsible projects, real estate investors can help improve the lives of those who may not have access to decent shelter or quality education. In addition, investing in sustainable real estate can lead to socio-economic benefits such as creating jobs and fostering economic growth.

Economic benefits of sustainable real estate investment include boosting local economies and creating wealth creation opportunities for everyone involved in the project from developers to tenants/owners.By using innovative design

Sustainable development goals and real estate

The Sustainable Development Goals (SDGs) are a set of internationally agreed upon targets to be achieved by all countries by 2030. One of the goals is to “protect the planet, its environment and sustainable development”. To help achieve this, SDG 8 calls for “good land management” which includes taking into account the needs of people and ecosystems when making decisions about land use. This can have a big impact on real estate investment, as many projects rely on acquiring or conserving land.

There are several ways to achieve good land management through sustainable development goals. One way is to encourage better forest management practices in order to reduce deforestation and improve forest coverage. Another way is to promote measures that reduce urban sprawl and help cities form more compact boundaries. Reducing energy consumption and waste production can also have a big impact on reducing greenhouse gas emissions and improving air quality. Taken together, these measures could lead to a reduction in the need for new real estate developments, helping to protect both the environment and economic interests.

Conclusion

Sustainable development goals (SDGs) offer a unique opportunity for real estate investors to partner with responsible developers and help create more sustainable communities. By working together, we can promote economic growth while protecting the environment. As this article has shown, investing in green real estate is a win-win for everyone involved. Thank you for reading!