Introduction: Seizing Opportunities in Real Estate Investment

In the ever-evolving realm of real estate investment, opportunities abound for those with the vision to seize them. One of the most promising prospects on the horizon is the concept of Opportunity Zones. These zones offer more than just the promise of financial growth; they provide significant tax incentives for astute investors. In this comprehensive guide, we will embark on a journey through the world of Opportunity Zones, delving into the intricacies of tax benefits, offering insights into zone selection, and emphasizing the importance of a well-crafted, long-term investment strategy to unlock the full potential of real estate endeavors.

Unraveling the Concept of Opportunity Zones

Opportunity Zones Unveiled

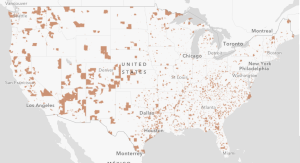

Opportunity Zones are designated areas, often grappling with economic challenges, that have been handpicked and endorsed by the government to attract private investment and rejuvenate local communities.

Unlocking Tax Benefits

The true allure of Opportunity Zones lies in the array of tax incentives they offer to investors:

- Capital Gains Tax Deferral: Investors can postpone the payment of capital gains taxes by reinvesting them into Opportunity Zones until December 31, 2026, or until the Opportunity Zone investment is sold, whichever comes first.

- Capital Gains Tax Reduction: Holding an Opportunity Zone investment for 5 years leads to a 10% reduction in the deferred capital gains tax, with an additional 5% reduction after 7 years.

- Tax-Free Gains on Opportunity Zone Investments: By retaining an Opportunity Zone investment for at least 10 years, any new gains from that investment become entirely tax-free.

Maximizing the Potential of Opportunity Zones

Crafting a Winning Investment Strategy

To fully harness the potential of Opportunity Zones, consider implementing these strategies:

- Zone Selection Mastery: Rigorously research and identify high-potential Opportunity Zones based on factors like economic growth potential, real estate demand, and demographic trends.

- Diversification Wisdom: Enhance returns and manage risk by diversifying investments across multiple Opportunity Zones.

- Long-Term Vision: Adopt a patient, long-term investment horizon to make the most of the tax incentives and the appreciation potential of your Opportunity Zone investments.

- Expert Advisory: Collaborate with seasoned tax professionals, financial advisors, and real estate experts to gain insights and guidance tailored to your investment goals.

Image by: https://eig.org/

Navigating Regulatory Complexities

The Prerequisite of Due Diligence

Before venturing into Opportunity Zone investments, diligent research is essential:

- Regulatory Adherence: Familiarize yourself with and meticulously adhere to the specific regulations and requirements associated with each Opportunity Zone and investment.

- Substantial Improvement Requirements: Be aware of the substantial improvement criteria that may apply to real estate projects within Opportunity Zones.

Conclusion: Seizing the Opportunity

Opportunity Zones are like a knock on the door of real estate investment – an invitation to unlock potential and reap rewards. By understanding the nuances of tax benefits, conducting thorough research to pinpoint high-potential zones, and embracing a patient, long-term investment perspective, you can confidently navigate the complex landscape of Opportunity Zone investments. Beyond the allure of financial gains, investing in Opportunity Zones allows you to become a catalyst for positive change in underserved communities, making it a win-win proposition for astute investors. Welcome to a world where seizing opportunity goes hand in hand with financial growth and community development.