Introduction:

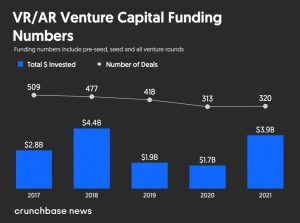

The concept of a digitally enhanced environment has been a long-standing fascination in modern society, fueled further by the futuristic vision of a holodeck in Star Trek: The Next Generation. Today, with exponential advancements in computational power, software engineering, and display capabilities, we are moving closer to turning this dream into reality. Augmented reality (AR) and virtual reality (VR) technologies are becoming increasingly viable, and venture capitalists are taking notice. In 2021, almost $4 billion was invested in AR/VR startups, making it the second-best year ever for VR/AR investment, just behind the $4.4 billion invested in 2018.

The question arises:

What drives this gold rush of venture capital investment in the AR/VR sector? Let’s explore the factors that are fueling investor interest in these cutting-edge technologies.

Augmented Reality vs. Virtual Reality

To understand the appeal of AR and \technologies, it’s essential to grasp the difference between the two. Augmented reality offers a hybrid digital experience, integrating both the real world and digital content in a partially immersive 3D interactive environment. It requires less computational power and hardware, making it more accessible to a broader audience.

On the other hand, virtual reality completely replaces the real world with a fully immersive, simulated one generated by computer graphics. The user’s interaction in a virtual world is governed by the system’s rules, whereas augmented reality allows users to have more control. Creating a credible virtual world demands significant computational power and advanced hardware, which has led to VR’s slower adoption compared to AR.

Investment in AR/VR Use Cases

AR and VR technologies have a broad spectrum of use cases that captivate venture capitalists:

- Education: AR and VR facilitate learning and skill assessment, particularly in dangerous or challenging scenarios that are hard to replicate in real life. They also enable remote collaboration and conferences, expanding the reach of educators.

- Product Design and Development: AR/VR serve as valuable tools in designing and developing physical products and spaces, allowing simulations in a digital environment.

- Gaming and Entertainment: VR, in particular, has gained traction in the gaming industry, offering total immersion and captivating experiences for gamers.

- Retail: AR/VR technologies are revolutionizing the retail sector, providing 3D catalogs for precise item assessment, interactive try-on visualization tools, and enhanced in-store experiences.

Challenges in the AR/VR Industry

Despite the immense market opportunities, the AR/VR industry faces some challenges that hinder monetization. VR experiences, in particular, require further improvements in hardware, such as miniaturization, weight reduction, and advanced sensors, to create seamless and immersive experiences.

Additionally, the absence of a dominant platform like Android or Windows creates uncertainty for innovators, making it harder to confidently build on a unified ecosystem. Security and privacy concerns are also paramount in completely immersive experiences that gather intimate user information.

Top AR/VR Investors

The AR/VR space has attracted diverse investors, including corporate venture capitalists and specialized AR/VR-focused firms:

- Bloomberg Beta and Intel Capital: Corporate venture capitalists investing in AR/VR due to the potential benefits in transparency, productivity, and remote work.

- Dune Ventures: An AR/VR-focused early-stage VC firm with investments in gaming, esports, interactive content, and interactive technology startups.

- HCVC (Hardware Club Venture Capital): A community-based VC firm supporting hardtech startups and providing assistance with business challenges.

- Boost VC and Lux Capital: Large traditional VC firms known for investing in leading-edge technologies, with a keen interest in AR/VR advancements.

The Future of AR/VR Investment

AR and VR technologies offer diverse opportunities for venture capital investment, with AR being a safer short-term option and VR offering greater potential in the long run. The market is still nascent, but it presents a dynamic landscape with clear beachhead markets and ample room for technological advancement. While hardware investments come with risks, they also offer significant rewards for those willing to take the plunge.

As AR and VR continue to mature and find their foothold in various industries, venture capitalists are keen to support startups that can innovate and capture the immense potential of these immersive reality technologies. The future is promising for those who dare to embrace the virtual world and create revolutionary experiences for a global audience.