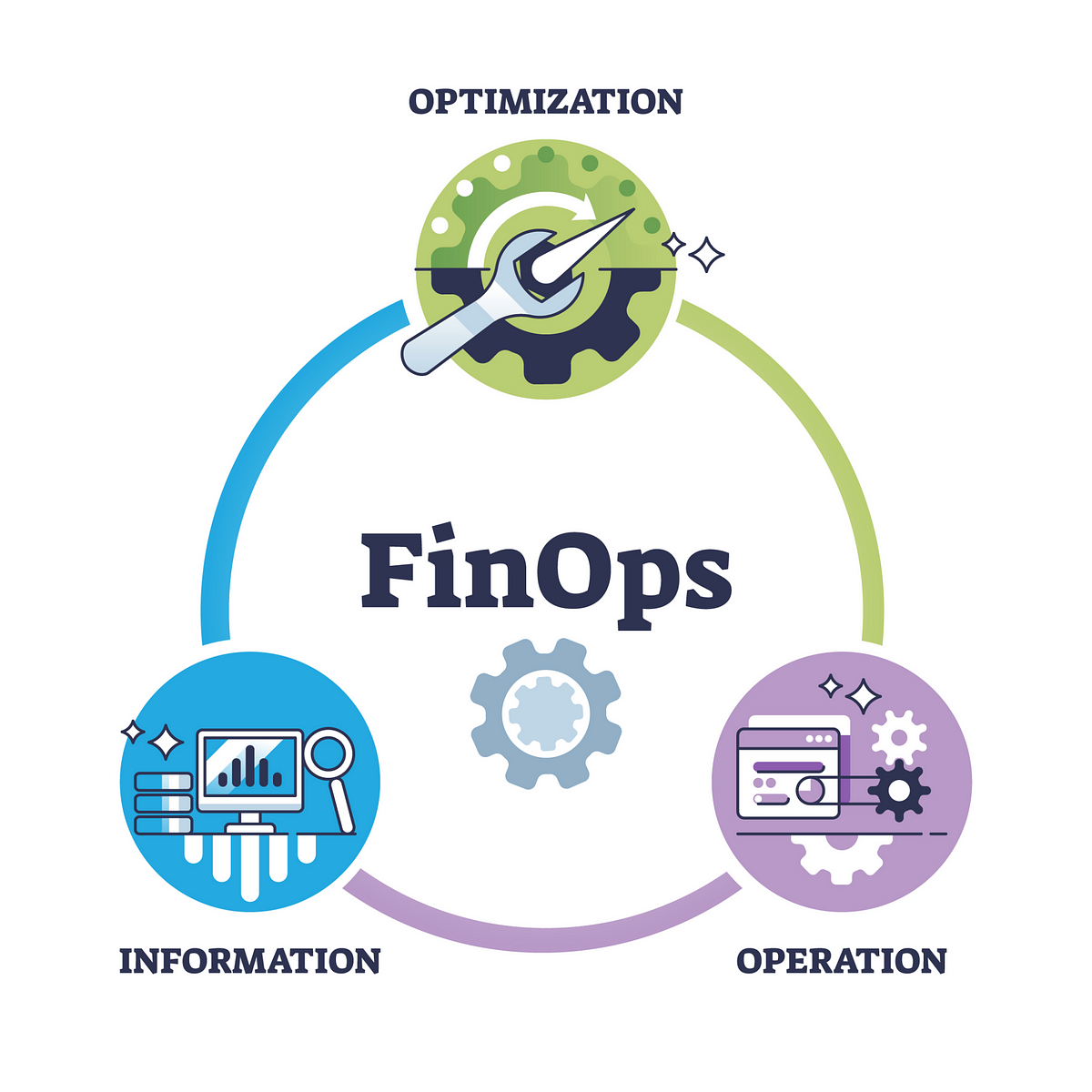

Financial Operations, commonly known as FinOps, represents a significant evolution in the management of financial processes within modern businesses. This paradigm integrates financial management with operational strategies to optimize the expenditure and resource allocation in dynamic business environments. By leveraging technology and data analytics, FinOps aims to create a seamless and transparent financial ecosystem that enhances decision-making and drives efficiency.

The Evolution of FinOps

FinOps has emerged as a response to the increasing complexity of financial management in today’s fast-paced business landscape. Traditional financial management practices often fall short in addressing the agile and responsive needs of contemporary enterprises. FinOps bridges this gap by incorporating real-time data, collaborative tools, and automated processes, fostering a proactive approach to financial governance.

Historically, financial operations were siloed, with finance teams working independently from other departments. However, the advent of digital transformation has necessitated a more integrated approach. FinOps embodies this shift, promoting cross-functional collaboration and breaking down silos to ensure that financial strategies align with overall business goals.

Core Principles of FinOps

At the heart of FinOps are several core principles that guide its implementation and practice:

- Collaboration: FinOps emphasizes collaboration between finance, operations, and business units to ensure alignment of financial strategies with business objectives.

- Transparency: Providing clear visibility into financial data and operations is crucial for informed decision-making and accountability.

- Optimization: Continuous improvement and optimization of financial processes are essential to drive efficiency and reduce costs.

- Accountability: Establishing accountability across teams ensures that financial decisions and actions are aligned with organizational goals.

- Automation: Leveraging automation and technology to streamline processes, reduce manual efforts, and enhance accuracy.

Implementing FinOps in Modern Businesses

The implementation of FinOps involves a strategic approach that includes several key steps:

- Assessment and Planning: Evaluate current financial processes and identify areas for improvement. Develop a comprehensive plan that outlines the goals, strategies, and resources required for FinOps implementation.

- Technology Integration: Deploy advanced technologies such as cloud computing, AI, and data analytics to support FinOps practices. These tools enable real-time data access, automated reporting, and predictive analytics.

- Cross-Functional Collaboration: Foster collaboration across finance, operations, and business units to ensure cohesive financial management. Regular meetings, shared dashboards, and collaborative platforms can facilitate this process.

- Continuous Monitoring and Optimization: Implement mechanisms for continuous monitoring of financial performance and process optimization. Regular audits, performance reviews, and feedback loops are essential for sustained improvement.

- Training and Development: Invest in training and development programs to equip employees with the necessary skills and knowledge to effectively operate within a FinOps framework.

Benefits of FinOps

The adoption of FinOps offers numerous benefits to modern businesses:

- Enhanced Decision-Making: Real-time data and analytics provide actionable insights, enabling better-informed financial decisions.

- Cost Efficiency: Optimization of financial processes reduces operational costs and enhances resource utilization.

- Agility and Flexibility: FinOps supports agile financial management, allowing businesses to quickly adapt to changing market conditions.

- Improved Transparency: Clear visibility into financial operations promotes transparency and accountability across the organization.

- Strategic Alignment: Aligning financial strategies with business objectives ensures that financial management supports overall organizational goals.

Challenges in FinOps Implementation

Despite its benefits, implementing FinOps is not without challenges. Some of the common obstacles include:

- Cultural Resistance: Resistance to change can hinder the adoption of new financial practices and technologies.

- Data Silos: Integrating data from disparate sources can be challenging and may require significant effort and investment.

- Skill Gaps: Lack of expertise in advanced technologies and data analytics can impede the effective implementation of FinOps.

- Regulatory Compliance: Ensuring compliance with financial regulations and standards is critical and can add complexity to FinOps initiatives.

- Initial Costs: The upfront investment required for technology integration and training can be substantial.

Case Studies of Successful FinOps Implementation

To illustrate the impact of FinOps, consider the following case studies:

- Company A: By adopting a FinOps framework, Company A was able to reduce its operational costs by 20% within the first year. The integration of real-time data analytics enabled more accurate forecasting and budgeting, resulting in improved financial performance.

- Company B: Facing challenges with financial transparency and accountability, Company B implemented FinOps to streamline its financial processes. The move led to a 15% increase in operational efficiency and enhanced collaboration across departments.

- Company C: With the help of automated reporting and predictive analytics, Company C improved its decision-making process, leading to a 10% increase in revenue growth. The alignment of financial strategies with business goals played a key role in this success.

Comparative Analysis of Traditional Financial Management vs. FinOpsX

| Aspect | Traditional Financial Management | FinOps |

| Approach | Siloed, department-specific | Integrated, cross-functional |

| Data Access | Periodic, often delayed | Real-time, continuous |

| Decision-Making | Reactive, based on historical data | Proactive, based on predictive analytics |

| Transparency | Limited, department-centric | High, organization-wide |

| Technology Utilization | Limited, manual processes | Extensive, automated processes |

| Collaboration | Minimal, siloed departments | High, collaborative across functions |

| Optimization | Infrequent, based on periodic reviews | Continuous, driven by real-time data |

| Accountability | Department-specific | Shared, across teams |

| Cost Efficiency | Variable, often high operational costs | High, optimized resource utilization |

| Agility | Low, slow to adapt to changes | High, quickly adaptable to market conditions |

Future of FinOps

The future of FinOps is promising, with several trends expected to shape its evolution:

- Increased Automation: The continued advancement of AI and machine learning will drive further automation of financial processes, reducing manual efforts and increasing accuracy.

- Enhanced Data Analytics: The use of big data and advanced analytics will provide deeper insights and support more strategic financial decision-making.

- Greater Integration: The integration of FinOps with other business functions, such as supply chain management and customer relations, will create a more cohesive and efficient operational ecosystem.

- Regulatory Evolution: As financial regulations evolve, FinOps practices will need to adapt to ensure compliance while maintaining efficiency.

- Skill Development: The demand for skills in data analytics, technology integration, and collaborative financial management will grow, necessitating continuous training and development.

Analysis Table of FinOps Principles and Benefits

| Principle | Description | Benefits |

| Collaboration | Cross-functional teamwork and shared financial goals | Enhanced decision-making, improved strategic alignment |

| Transparency | Clear visibility into financial data and operations | Increased accountability, better financial control |

| Optimization | Continuous improvement of financial processes | Cost efficiency, resource optimization |

| Accountability | Shared responsibility for financial outcomes | Consistent goal alignment, improved performance |

| Automation | Use of technology to streamline financial processes | Reduced manual efforts, increased accuracy |

Comparative Table: Traditional Financial Management vs. FinOps

| Aspect | Traditional Financial Management | FinOps |

| Approach | Siloed, department-specific | Integrated, cross-functional |

| Data Access | Periodic, often delayed | Real-time, continuous |

| Decision-Making | Reactive, based on historical data | Proactive, based on predictive analytics |

| Transparency | Limited, department-centric | High, organization-wide |

| Technology Utilization | Limited, manual processes | Extensive, automated processes |

| Collaboration | Minimal, siloed departments | High, collaborative across functions |

| Optimization | Infrequent, based on periodic reviews | Continuous, driven by real-time data |

| Accountability | Department-specific | Shared, across teams |

| Cost Efficiency | Variable, often high operational costs | High, optimized resource utilization |

| Agility | Low, slow to adapt to changes | High, quickly adaptable to market conditions |

Conclusion

FinOps represents a transformative approach to financial management, aligning financial strategies with business objectives through collaboration, transparency, and optimization. By leveraging technology and data analytics, FinOps enables modern businesses to navigate the complexities of today’s financial landscape, driving efficiency, agility, and strategic alignment. As organizations continue to adopt and refine FinOps practices, they can expect to achieve significant improvements in financial performance and overall business success.